Aadhaar Card Safety Tips

Aadhaar Card is not just an identity card but, a mandatory document for getting banking and other Government benefits. Our Aadhaar card is a unique document as it contains essential information including demographic and biometric details. Although the Unique Identification Authority of India (UIDAI) claims that the base is completely safe, taking precautions are also necessary.

Below mentioned are some of the safety tips:

- To avoid unintended Aadhaar based transactions in your bank account, you are advised to lock your biometrics in UIDAI. Please click here for process to lock/unlock your biometrics.

- Do not share your base One Time Password (OTP) with any person or agency. No UIDAI representative asks for an OTP through call, e-mail or SMS. So, do not share the OTP with anyone.

- UIDAI also recognises digital Aadhaar card. Hence, instead of printing the base, you can save the digital copy in your mobile or laptop. If you are downloading it on a public machine, do not forget to delete its local copy.

- For basic verification and other features, please register your mobile number. If you have not yet registered your number or changed the number then update it by visiting the nearest base centre.

- Do not forget to mention the purpose of the documents during its submission. For example: Suppose you share your Aadhaar card photocopy for a bank account opening, you should write on it as ‘Identity proof for account opening only at <XYZ> Bank’.

- You can now visit the official website of UIDAI and easily track the history of your Aadhaar card. This will enable you to know the details where the unique identification code was used.

- You can also visit the official website of UIDAI to check whether it has an Aadhaar biometric lock or unlock system to protect the privacy of your Aadhaar data.

- You must monitor your Aadhaar transactions regularly from UIDAI’s official website by logging in with your personal credentials.

- Update your Aadhaar details only at UIDAI authorised agencies.

- Do not share your Aadhaar number on social media.

- If you suspect any misuse of your 12-digit unique number, please notify the concerned authorities immediately.

- Do not share your Aadhaar mobile application password with anyone and never keep the password same as the one you use for logging into your computer or for accessing your e-mail.

Features of AePS (Aadhaar Enabled Payment System)

An AePS enables the customers to do financial as well as non-financial transactions in their Aadhaar linked Accounts, by using their Aadhaar Number and through biometric authentication.

- Inter-operable

- Instant transaction posting

- Fund transfer, using Aadhaar Number

- No peripheral requirement for customers, like cards or smart phones, to do the transactions

- Transactions can be done at any nearest Business Correspondent (BC) point thus, eliminating the need to visit the Bank branch

- Transaction is secured through a biometric authentication. The customer needs to read and give his/her consent for biometric authentication

- Biometric Authentication can be done either through a fingerprint or through the iris

- Post transaction posting, the customer will receive an SMS on his/her registered mobile number

- The customer should not share their Aadhaar number with any third party for doing the transactions. The customer must himself/herself do the transaction.

Benefits for customers

- No need to carry a smart phone/card for the transaction

- No need to visit the Bank branch, for implementing the transactions

- Easy fund transfer form your Aadhaar linked account to another account

- Visit any bank’s nearest BC point, for the transaction

- Transact from any Aadhaar enabled bank account

- No security issues, as the transaction is carried out through biometric authentication

- No need to pay extra charges, for the transaction.

DO’s for the Aadhaar usage

- Aadhaar number captured on any form or in the Aadhaar copy must be masked, while submitting at the Bank. The initial 8-digits of the Aadhaar Number need to be masked

- At the time of linking your Aadhaar to an existing account or a new account or while submitting the Aadhaar Card as a KYC document, the Bank will ask for the customer’s consent

- The biometric information of children is to be updated, upon attaining <5> years of age and <15> years of age, in accordance with the procedure specified by the authority

- Clean the finger, as well as the fingerprint scanner, before performing the fingerprint authentication based transaction

- Customers must ensure to enter the correct Aadhaar Number, for initiating transactions

- Ensure the proper placement of your finger on the scanner

- In case a customer does not want to disclose the Aadhaar Number, then he/she can also generate and use a Virtual ID (VID) for doing Aadhaar enabled transactions

- A 12-digit Aadhaar Number is mandatory, for the receipt of subsidies and benefits under the Government schemes

- Aadhaar linking is not mandatory, however, once your Aadhaar is linked to a Savings Account, it enables the customer to do Aadhaar enabled transactions, like AePS and Aadhaar Pay

- Post any transaction, a customer must ensure to collect the physical or digital slip from the BC agent

- In case of any transaction related dispute, a customer can call the ICICI Bank Customer Care number.

DON’Ts for Aadhaar usage

- Please do not share the unmasked Aadhaar number, in any physical form or as a KYC document

- Do not use greasy, sweaty and dry fingers, while performing the biometric authentication based transaction

- Performing transactions with mehndi or tattoo on your hands, will increase the chances of an authentication failure

- Never give your fingerprint, except for processing of any transaction

- In case a customer gets a U3 (Biometric mismatch) more than once, then he/she may use their iris for authentication or must switch to the other mode of transaction

- Do not use third-party Aadhaar for doing authentication.

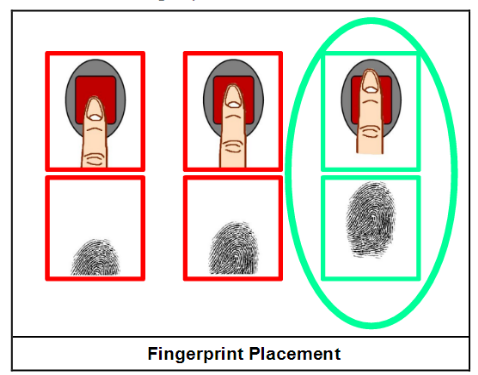

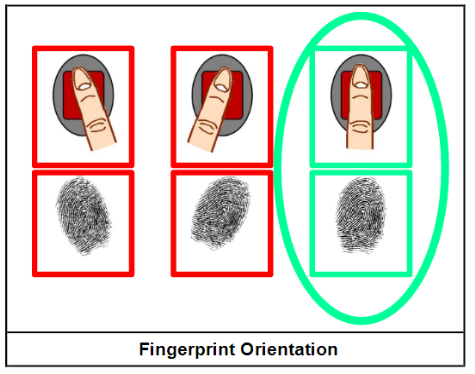

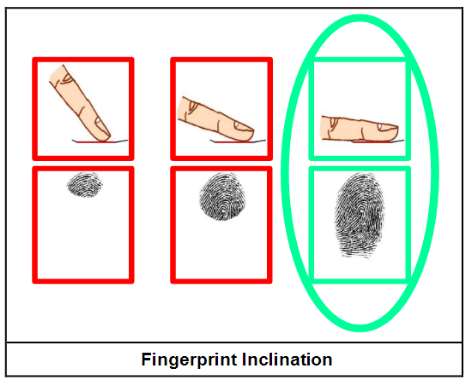

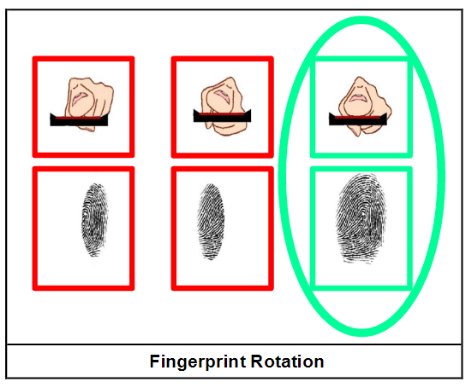

Finger Placement Rules

Biometric performance is successful, when the finger is optimally positioned. Best finger placement is shown below.

|

|

|

|

- The customer to visit the nearest BC point and select the transaction type as AePS

- The customer to enter the Aadhaar Number, amount, bank name and submit his/her biometric for authentication

- On successful authentication, the transaction posting will be carried out and a print slip will be handed over to the customer.

At ICICI Bank BC points, customers can withdraw or deposit Rs <10,000>, in a single attempt, subject to not breaching the total limit.

The customer has to enter his/her Aadhaar Number, amount, bank name and his/her biometric.

The customers can do biometric authentication either through a fingerprint or through iris.

- If the customer enters an incorrect Aadhaar number or selects an incorrect bank, where he/she does not have an Aadhaar linked Bank Account, then the transaction shall be declined, with an appropriate response

- Further as the customer may have linked his/her Aadhaar with multiple banks, the customer should select the correct bank from where he/she wishes to do the transaction.

Yes, a customer can do an AePS transaction at any bank BC point, however, for Aadhaar to Aadhaar fund transfer, customers need to visit the specific bank BC point, from which he/she wants to transfer the fund.

Customers do not have to pay any charges to anyone for AePS transactions.