- Gold Loan

- Insta Loan against Mutual funds

- Personal Loan

- Home Loan

- Pragati Home Loan

- iWealth Faqs

- iWealth Faqs

- Loan Against Securities

- Personal Loan

- Home Loan

- Gold Loan

- Two Wheeler Loans

- Home Loan

- Home Loan

- Home Loan

- Personal Loan

- Car Loan

- Two Wheeler Loans

- Gold Loan FAQs

- Gold Loan

- Gold Loan

- car-loans

- Commercial Vehicle Loans

- Construction Equipment Loans

- Personal Loan

- farmer-finance

- Other loans

- Healthcare Equipment Loans

- Pre-qualified Loans

- Terms and Conditions

- Commercial Business Loans

- Consumer EMI

- Education Loan

- Car Loan

- Loan for Sure

- Cardless EMI

- e-Mandate

- Loans

- Other Loans

- icici-home-search

- test comp

- Commercial Vehicle Loans

- Maha Loan Dhamaka

- Loan Against Gold

- Pradhan Mantri Mudra Yojana

- How to Apply

- Stand Up India Scheme

- Pradhan Mantri Mudra Yojana

- Pradhan Mantri Mudra Yojana

- Effective ROI FAQ’s

- Gold Loan FAQs

- Insta Education Loan Faqs

- Balance Transfer PA FAQs

- iWealth Faqs

- PMAY FAQ’s

- Loans without Financials FAQs

- Loan Against Securities

- Home Loan

- Gold Loan

- Smart Loans

- Two Wheeler Loans

- Carloan1

- Personal loan EMI Calculator Standardization

- Two Wheeler Loan EMI Calculator Standardization

- LAP

- Documentation

- Gold Loan Topup

- Eligibility Calculator

- Doorstep Gold Loans

- More

Want us to help you with anything?

Request a Call back

Gold Loan FAQs

What is a Gold Loan?

A loan against your gold jewellery is known as a Gold Loan or a Jewel Loan. At ICICI Bank, a customer can quickly avail a Gold Loan of any value between Rs 50,000 to Rs 1 crore.

Features of Gold Loan like ease of documentation and instant disbursal make it an easy and convenient way of securing funds.

How does one get a Gold Loan?

To get a Gold Loan, you can walk into any ICICI Bank Branch offering a Gold Loan, with your jewellery and avail a Gold Loan of any value between Rs 50,000 to Rs 1 crore. With our simple documentation process (only KYC required), you can avail the loan across the counter, quickly. Alternatively, you can give a missed call on 84448 84448 or call us on 1800 1080 or apply online. Our representative will call you and guide you with all the necessary details. You can also check your Gold Loan eligibility with our Gold Loan calculator.

What is the interest rate of a Gold Loan?

ICICI Bank Gold Loan comes with a minimum interest rate of 10% p.a. based on the prevalent market situation. The Gold Loan interest rates will vary according to the product variants.

How long does it take to complete a Gold Loan approval process?

ICICI Bank Gold Loan provides a quick loan disbursal subject to the verification of the gold and other documents that you submit. The approvals are at the sole discretion of ICICI Bank.

What documents are required for the approval of a Gold Loan?

The Gold Loan documentation process is very simple. It does not require you to share the income proofs. The documents required for a Gold Loan are:

- Two passport size photographs

- Identity proof such as Driving Licence/ Form 60/Form61/ Passport Copy/ Voter ID Card/ Aadhaar Card/ Ration Card (any one). PAN Card issued in India is no longer considered as a valid identity proof

- Address proof such as Driving Licence/ Voter ID Card/ Ration Card/ Aadhaar Card/ Passport Copy/ Registered lease agreement with utility bills not older than 3 months in the name of your landlord (any one)

- Proof of land holding needs to be provided in case of an Agricultural Loan of more than Rs 1 lakh

What is the maximum limit on the Gold Loan that can be availed?

A Gold Loan can be availed for a minimum of Rs 50,000 and maximum of Rs 1 crore per customer.

Gold loan Blogs

Gold Loan Reviews

Very nice behavior and supportive staff. He helped me open a Gold Loan Account easily. Thanks for your co-operative behavior Mr. Pawan Sharma.

I have availed a Gold Loan from your bank i.e. ICICI Bank, Jamalpur Branch and I am very satisfied with your services. The staff was very polite in dealing with us. It helps that the interest will be levied at the end of the tenure. Even the time taken for processing the Gold Loan was less than most other banks.

I have availed a Gold Loan from ICICI Bank and the bank services are very good, in terms of Customer Service and the processing time of the loan. The loan processing time is less compared to other banks and the bank charges interest at the end of loan tenure. This feature is really the best.

I have availed a Gold Loan from ICICI Bank and the bank services are very good, in terms of Customer Service and the processing time of the loan. The loan processing time is less compared to other banks and the bank charges interest at the end of loan tenure. This feature is really the best.

Apply for Gold loan

at your convenience

- Mobile Banking

- Net Banking

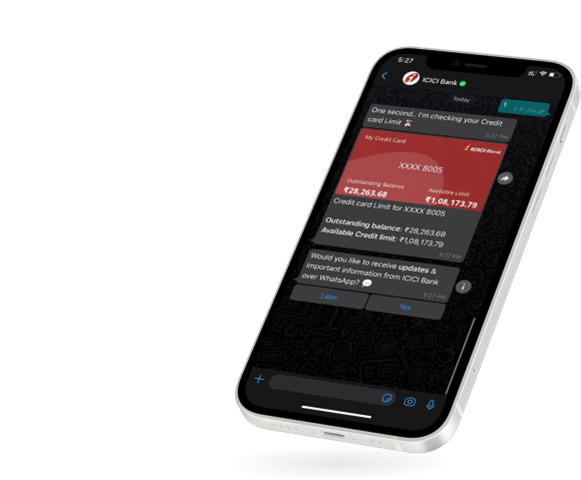

- WhatsApp Banking

Download

iMobile App

Click to Enlarge

Download

Pocket

Click to Enlarge

Apply for Gold loan

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking