- Personal Loan

- Service Charges & Fees

- moderation

- Personal Loan in Chennai

- Terms And Conditions

- Pre-Approved Loan

- Overdraft Against Salary

- Application Process

- Top Up Loan

- Home Renovation

- Online Application Process

- Wedding Loans

- Request Call Back

- Fresher Funding

- NRI Personal Loan

- Interest Rates

- Personal Loan in Bangalore

- Documentation

- EMI Net Banking

- Review

- Personal Loan Balance Transfer

- Types of Personal Loans

- Personal Loan

- Holiday Loan

- atm-pl-disbursement

- Business Instalment Loan

- Personal Loan in Mumbai

- Pre Qualified

- Personal Loan in Pune

- pl-iframe

- Relationship Based Loans

- Wedding Loans

- Terms and Conditions

- Personal Loans Faqs

- Overdraft Against Salary

- Personal Loan App

- Personal Loan on Credit Card

- Personal Loan Eligibility Calculator

- 9 Lakh Personal Loan

- Personal Loan for Salaried Employees

- Personal Loan for Medical Emergency

- EMI Calculator

- Personal Loan of Rs. 60,000

- 1 Lakh Personal Loan

- Rs 15 lakh Personal Loan

- Rs. 4 lakh Personal Loan

- Rs 3 lakh Personal Loan

- Rs 10 lakh Personal Loan

- Rs. 20 lakh Personal Loan

- Rs. 50,000 Personal Loan

- Rs. 90,000 Personal Loan

- Rs.70,000 Personal Loan

- 2 Lakh Personal Loan

- Personal Loan of Rs. 60,000

- Rs. 80,000 Personal Loan

- Personal Loan App

- Personal Loan Eligibility Calculator

- FAQS

- APPLY NOW

- More

Want us to help you with anything?

Request a Call back

PERSONAL LOAN

Secure Personal Loan up to Rs. 50 lakhs

-

Minimal documentation

-

Flexible tenure up to 72 months*

-

Loan amount of up to ₹ 50 lakh*

-

Online application and disbursement

-

Attractive interest rates starting @ 10.85%*

Personal Loan EMI Calculator

Disclaimer*: Our Personal Loan EMI calculator offers estimated monthly installments which are indicative and tentative and are based upon the details populated by the user. Actual loan terms and eligibility are subject to bank approval. For precise loan details, consult our representatives before decisions based on these estimates.

Personal Loan: Benefits & Features

No Foreclosure charges

Zero Pre-closure charges, if 12 EMIs are Paid.

Flexible tenure

Enjoy the convenience of choosing a repayment tenure that suits your financial situation and goals.

Minimal Documentation

Personal loans require minimal documentation, streamlining the application process and reducing paperwork.

Fixed Interest Rates

Benefit from stable and predictable interest rates, ensuring consistency in your monthly payments.

No collateral required

Secure a personal loan without the need to pledge collateral, simplifying the borrowing process and reducing the risk.

Personal Loan Interest, Documents & Eligibility

Personal Loan Interest, Fees And Documents

- Rate of Interest: 10.80% to 16.15% per annum

- Processing Fees: Up to 2.00% of loan amount plus applicable taxes

- Tenure: 12 months to 72 months

- Documents Required: Salary slips for the last 1 month, latest 3 months Bank Statements, Passport / Driving License / Voters ID / Aadhar Card (any one)

Personal Loan Eligibility Criteria

To apply for a Personal Loan, you must be

- Over 20 years old and a resident of India

- Salaried individual, having a regular monthly income.

- Having a good bureau score

- Having a Salary Account with any of the banks in India

Disclaimer : The products, services and offers referred to herein are subject to the Terms and Conditions governing them as specified by ICICI Bank from time to time at www.icicibank.com. Nothing contained herein shall constitute or be deemed to constitute an advice, invitation or solicitation to purchase any products / services of ICICI Bank.

Multi-Purpose Personal Loan from ICICI Bank

Loans for Medical Emergency

These loans offer a financial lifeline during times of unexpected health crises. Providing peace of mind and resources needed to access crucial medical care and ensuring your health and wellbeing are the top priorities.

Loans for Marriage Expenses

When it comes to your special day, these loans make your dreams come true. Easing the financial burden and allowing you to create cherished memories without compromise, ensuring your wedding is as beautiful as you envisioned.

Home Renovation

Transforming your living space into a dream home becomes effortless with these loans. Empowering you to enhance your surroundings, making your living environment comfortable and inspiring.

Loans for Appliances and Gadgets

Stay on the cutting edge of technology with these loans. They enable you to upgrade your gadgets, ensuring you have the tools and devices needed for work, leisure, and staying connected.

Loans for Travel

Unlock the world of travel, fulfilling your wanderlust and creating unforgettable adventures. They provide the means to explore diverse cultures, breathtaking landscapes, and new horizons.

Loans for Online Courses

Invest in your personal and professional growth with these loans. They empower you to pursue knowledge and skills through online courses, opening doors to new opportunities and career advancement.

Popular Personal Loan FAQs

What is a Personal Loan?

Personal Loan is an unsecured Loan and one of the best loans for marriage expenses, paying medical bills or planning your dream vacation. Personal Loans can act as a financial cushion for you at the time of emergency. Whatever your financial goals are, ICICI Bank Personal Loans cater to all your needs. Availing a Personal Loan is not restricted to just emergencies, you can apply for a Personal Loan to fund your vacation as well. You can also check Personal Loan EMIs with our Personal Loan EMI calculator.

You can apply for a Personal Loan online from our ICICI Bank website and meet your diverse financial needs. You can avail a Personal Loan up to Rs. 50 lakh and meet a sudden personal emergency. The process of Loan application is instant and convenient and can be done online from the comfort of your home. The instant Personal Loan approval process ensures you have a seamless and stress-free borrowing experience. Also, with our instant Personal Loan online services, you can get access to funds within 3 seconds.

How does one avail an instant Personal Loan online with ICICI Bank?

Visit our website to secure an instant Loan with ICICI Bank. After checking your Pre-approved Offer, check your eligibility, fill in and submit your Personal Loan application. Select the Loan amount and tenure as per your requirement. Check your Personal Loan approval status. You will receive an instant Loan approval and the amount will be disbursed into your Account immediately.

What are the required documents for a Personal Loan with ICICI Bank?

A. For Salaried Individuals:

1. Proof of Identity/Residence: Any one of the below Official Valid Documents (OVD) can be accepted as Current / Communication address proof only.

Passport

Driving License issued by Regional Transport Authority

Voter's Identity Card issued by the Election Commission of India

Letter from National Population Register containing details of name and address

Proof of possession of complete AADHAR Card

NREGA Card.

2. Latest 3 months* Bank Statement (where salary/income is credited)

3. Salary slips for the last 3 months*

B. For Self-Employed:

1. Proof of Identity/Residence: Any one of the below Official Valid Documents (OVD) can be accepted as Current / Communication address proof only.

Passport

Driving License issued by Regional Transport Authority

Voter's Identity Card issued by the Election Commission of India

Letter from National Population Register containing details of name and address

Proof of possession of complete AADHAR Card

NREGA Card

2. Income Proof :

Audited financials for the last two years

Latest 6 months* Bank Statement

3. Office address proof:

4. Proof of residence or office ownership

5. Proof of continuity of business.

*Conditions applied as per policy.

*ICICI Bank reserves the rights to call upon additional documents at its discretion.

Do I need to provide a security or collateral to apply for a Personal Loan with ICICI Bank?

No, ICICI Bank offers its customers a collateral-free Personal Loan without any security. Visit our website to apply for an instant Personal Loan online.

What is the minimum and maximum amount of Personal Loan offered by ICICI Bank?

ICICI Bank offers Personal Loans starting at Rs. 50,000 up to Rs. 50,00,000.

What is the interest rate on an ICICI Bank Personal Loan?

ICICI Bank currently offers a Personal Loan at interest rates ranging from 10.80% to 16.15%.

What is the repayment tenure of a Personal Loan?

ICICI Bank Personal Loan repayment tenure ranges from 12 months to 72 months.

What is the Personal Loan processing time?

The Loan approval process at ICICI Bank is simple, quick and instant. Once a customer's Personal Loan is approved, it takes only 3 seconds for the amount to be disbursed into your Account.

What are the advantages of taking a Personal Loan with ICICI Bank?

The advantages of an ICICI Bank Personal Loan are:

- Attractive Interest Rates

- Flexible Tenure Options

- Low EMI Amount

- Easy Application Process

- Pre-Approved Offers

- No Collateral Required

- Quick Disbursement

- Quick Assistance

- Digital Process

- Minimal Documentation.

Can I foreclose my Loan with ICICI Bank?

Personal Loan foreclosure facility is extended to all customers availing a Personal Loan with ICICI Bank. Customers can foreclose their Personal Loan after the payment of at least one EMI. However, foreclosure charges (and taxes) will be applicable as per the service charges.

Does a Personal Loan offer Tax benefits?

No, there are no Tax benefits and Tax deductions on Personal Loans.

What are the eligibility criteria for a Personal Loan?

Personal Loan Eligibility criteria for salaried individuals:

Age: Between 20 years and 58 years

Net salary**: Minimum monthly income of Rs 30,000

Total years of work experience: 2 years

Duration of years at the current residence: 1 year

Note:

**The minimum salary requirement will differ depending on the profile (type of employer, having a relationship with ICICI Bank etc.) of the customer.

Eligibility criteria for self-employed individuals:

Age: Minimum: 28 years (for self-employed individuals) and 25 years (for doctors). Maximum: 65 years

Minimum turnover: Rs 40 lakh for non-professionals and Rs 15 lakh for professionals as per audited financials

Minimum profit after tax: Rs 2 lakh for proprietorship firms/self-employed individuals and Rs 1 lakh for non-professionals as per audited financials

Business stability: In current business for at least 5 years and minimum 3 years for doctors

Existing relationship with ICICI Bank: Minimum 1 year liability relationship (Current or Savings Account) or loan relationship either live or closed in the last 36 months; repayment track as required.

Note:

ICICI Bank provides Personal Loans to self-employed individuals under business instalment loans.

Related Personal Loan Videos

Other types of Personal Loans

New Personal Loan

Looking for a fresh Personal Loan? Check your eligibility by filling personal and professional details and select a Loan amount which suits your requirement.

Top-up Personal Loan

Need more funds over and above your existing Personal Loans from ICICI Bank? Opt for our Top-up Loan at attractive rates of interest.

Personal Loan Balance Transfer

Do you have an existing Personal Loan from another bank? Transfer your existing Personal Loan to ICICI Bank at a lower rate of interest.

Flexicash

Looking for a short-term instant credit? Avail of a Line of Credit Overdraft facility and pay interest on the amount you use and the period you use it for.

NRI Personal Loan

Are you working abroad and looking for a Personal Loan? Apply for a collateral-free Personal Loan with a simplified documentation process.

Pre Approved Instant Personal Loan

Looking for an instant Personal Loan in just a few clicks? Check your eligibility for a Pre-approved Offer and avail a Personal Loan within just 3 seconds.

Business Loan

Are you a self-employed professional looking for a Loan? Apply for an unsecured Loan, similar to a Personal Loan but specifically designed for your business use.

Personal Loan Blogs

Apply for Personal Loan

Online at Your Convenience

- Mobile Banking

- Net Banking

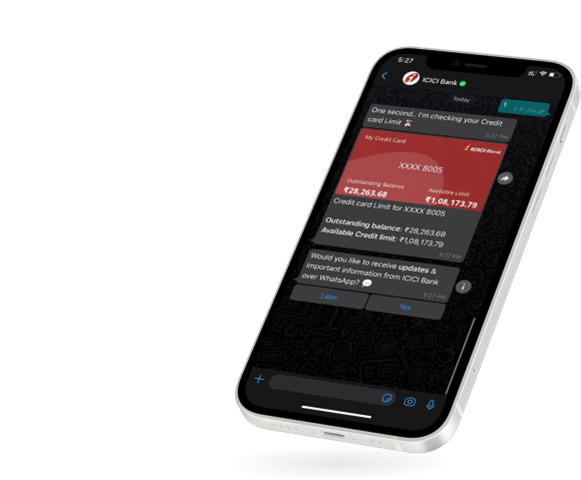

- WhatsApp Banking

Download

iMobile App

Click to Enlarge

Download

Pocket

Click to Enlarge

Apply for Personal Loan

Online at Your Convenience

Mobile Banking | Net Banking

WhatsApp Banking