Understanding Personal Loan for salaried employees

A Personal Loan for salaried employees is tailored to meet the financial requirements of individuals who have a regular income from employment. These loans are unsecured, meaning they do not require any collateral, making them a preferred choice for many. The key to their appeal lies in their simplicity and the speed with which they can be availed.

Advantages of an instant Personal Loan for salaried employees

The concept of an instant Personal Loan for salaried employees has gained significant traction in recent years. Thanks to digital banking, many lenders now offer quick loan approval and disbursal, sometimes even within minutes. This is particularly beneficial in emergencies where time is a major factor.

Key Features

Benefits of Personal Loan for Salaried Employees

Personal Loan Eligibility & Documents for Salaried Employees

Tips for managing your Personal Loan

- Plan your finances: Consider the loan repayment as part of your monthly budget.

- Timely repayment: Always pay your EMIs on time to maintain a good credit score.

- Understand the Terms and Conditions: Be clear about interest rates, processing fees, prepayment charges, etc.

Apply for Personal loan

at your convenience

at your convenience

- Mobile Banking

- Net Banking

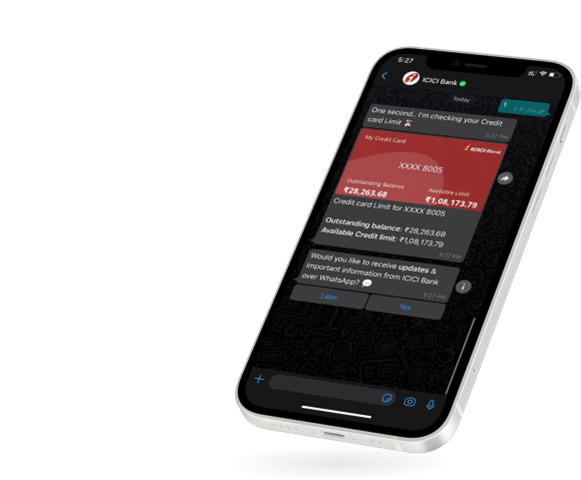

- WhatsApp Banking

Apply for Personal loan

at your convenience

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking