- ₹30,000

- ₹40 Lakhs

- ₹0

- ₹40 Lakhs

- 12 Months

- 72 Months

You are eligible for a total

loan amount of Rs

Disclaimer*: The information provided is not guaranteed to be accurate or complete and is indicative and tentative in nature. Users are advised to exercise caution and seek professional advice before making decisions based on it. ICICI Bank bears no liability for updating the data or for any losses arising from the use of this information.

Personal Loan Eligibility Criteria

See how easy it is to get a Personal Loan! Watch Now.

Personal Loan eligibility FAQs

How to check Personal Loan eligibility?

ICICI Bank offers Personal Loans to salaried and self-employed individuals. You can easily check your eligibility for a Personal Loan on our website. Click here to check your eligibility. If you are an existing customer of ICICI Bank, you can also check your eligibility for a Pre-approved Personal Loan offer on the iMobile Pay app and Internet Banking.

Can I get a Personal Loan if my monthly salary is Rs 30,000?

Yes, salaried applicants can get a Personal Loan from ICICI Bank with a minimum monthly salary of Rs 30,000. However, the minimum salary required may also differ depending on the applicant’s profile - nature of employment, employer, whether the employer has any relationship with ICICI Bank and so on.

How much Personal Loan can I get based on my salary?

Depending on your salary, credit score and employment status, you can get a Personal Loan starting from Rs 50,000 up to Rs 50 lakhs subject to ICICI Bank's internal policy. The amount is decided based on your age, income and other factors. This amount can also be increased depending on certain factors. It is best to get in touch with ICICI Bank directly to explore all your options.

Personal Loan eligibility blogs

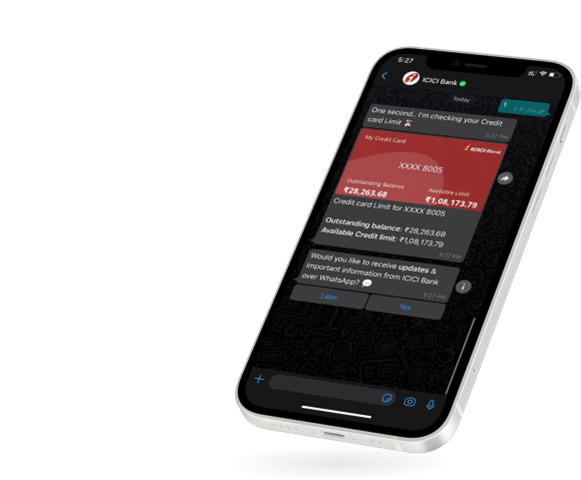

Apply for loans at

your convenience

your convenience

- Mobile Banking

- Net Banking

- WhatsApp Banking

Apply for loans at

your convenience

your convenience

Mobile Banking | Net Banking

WhatsApp Banking