Features and benefits of a Rs. 70,000 Personal Loan

Eligibility Criteria, Interest Rates, Fees and Documents Required for a Rs. 70,000 Personal Loan

Apply for Personal loan

at your convenience

at your convenience

- Mobile Banking

- Net Banking

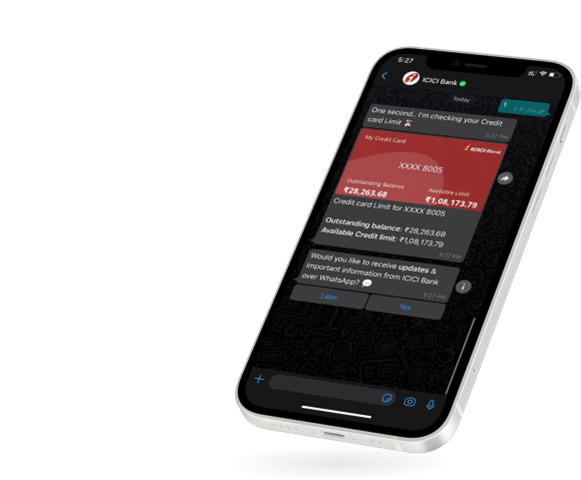

- WhatsApp Banking

Apply for Personal loan

at your convenience

at your convenience

Mobile Banking | Net Banking

WhatsApp Banking