- PPF_revamp_page

- iplaunica

- iplaunica

- test

- test

- test

- cbl

- mailer

- Rewards-sample

- Unica

- home

- img path

- test5

- test6

- Offer Zone

- Malicious Encoding

- Joy of giving

- Retail Digital Banking

- PayLater

- online-donation

- M52 Account

- iBox

- Offer Zone

- HPCL Super Saver Credit Card video

- Video KYC

- paymetry-iframe

- Steps to update PAN

- Ways to Bank

- Railways

- Savings Account | Open High Interest Rate Savings Account | Apply for Online Savings Account - ICICI Bank

- Survey

- test

- FAQs

- test-product-service

- unicanudge

- test

- test7

- test9

- Infosys Smart Card

- test12

- test13

- calculator

- retail-holidays-calendar

- Innovative Banking Solutions & Services by ICICI Bank

- faq-sample

- Consumer Finance

- ismart-solution

- ismart-solution

- Custom

- Demo

- test-iframe

- instabiz

- amp-testpage

- test11

- faq test

- blogs

- Customer Service Policies

- hometest

- test homepage

- AMP component testing

- Testpage

- Sample Page

- Savings Account

- C7

- Bizpay360

- Loan_test1

- loan2

- demo

- Personal Banking & Netbanking Services Online

- adobe QA

- QA (Mavis)

- QA-test

- erg filter treasure corner report

- research report CF

- Test SIP Revamp

- test

- test-banner

- test-document-checklist

- reviewdemo

- FAQs

- AAM-350

- demo

- GL_revamp page 1

- GL_revamp page

- GL_revamp page

- Fixed Deposit

- banner-feature

- Corporate FD Test

- Venkat-test

- Venkat-test2

- AAM-700 Test

- Test Banner V2

- Regular Savings Account

- upi

- test-special-offers

- Test Help Page

- test

- Deloitte Test 2

- Deloitte Test 3

- AAM-812 Revamp components

- Balance Transfer Test

- AAM-880 NPS Banner

- AAM-880 NPS Calculator

- AAM-895 PL Revamp Page Calculator

- Corporate Microsites

- Server-side

- Server-side-delay

- test

- Personal Loan

- Overdraft Against Salary

- Service Charges & Fees

- Personal Loan on Credit Card

- Personal Banking & Netbanking Services Online

- Institute

- Test

- Performance

- AAM-784

- Service Nli

- test-829

- NLI Authoring Guide

- New Cars in 2024: Check Price, Model, Features, & Images

- Track Service Requests

- AAM-668 Money2India

- Service Nli

- Corporate

- Contact Us

- ICICI Bank Customer Care Number - Toll Free No. 1800 1080

- Forms

- Compliments and Complaints

- Offer Zone

- qualityassurance

- Cars

- test-og

- Campus Power

- OG Tags 123

- test-og-tags-2

- test-page-d

- eligibilitycalculator

- Saving Calculator

- Offer Zone

- Testnew

- Tractor Loan

- family-banking

- Aboutus

- safe-online-banking

- Revamp Corporate FD Page

- Help Section Page

- Revamp 1.4 and 4.1a&b

- Personal Banking & Netbanking Services Online

- Personal Banking & Netbanking Services Online

- spryassets

- reviews

- Investment revamp

- Revamp Corporate FD Page

- Smart Card

- gst

- csr

- Orange Hub

- Calculators

- Offer Zone

- Cards

- About Us

- Personal Banking

- Privilege

- Business

- Internet Banking

- Errors

- Find ATM/Branch

- Bank ATM/ Branch Locator: Find ICICI Bank ATM Near Me - ICICI Bank

- Home

- Online Demo

- Online Demo

- ipal

- Business

- Disclaimer

- Campus Power

- swift-code

- ICICI Bank Customer Care Number - Toll Free No. 1800 1080

- Service Charges

- Notice Board

- Terms and Conditions

- Corporate

- Online Services

- NRI

- Personal Banking & Netbanking Services Online

- Safe Banking

- Cars

- Personal Banking & Netbanking Services Online

- Millennial

- Media Gallery

- Digital Banking

- SME

- Privilege

- SME Banking

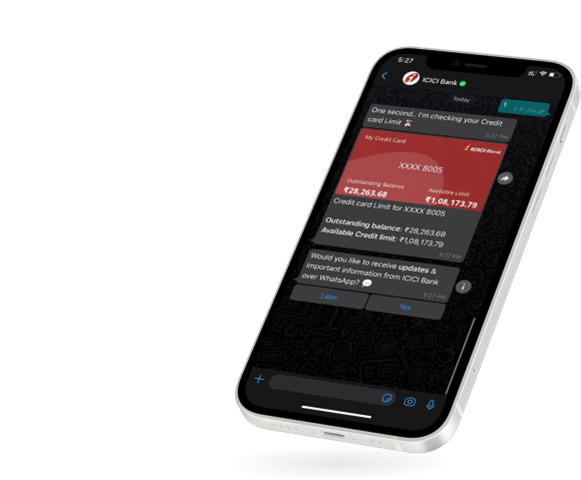

- Mobile Banking

- Wealth Management

- Compliments and Complaints

- Complaints

- Contact Us

- Agri & Rural

- SOTW

- Calculator

- Cards

- Speak of the Week

- Linkedin Disclaimer

- CIBIL - Grant of Consent

- Credit Information Bureaus and 'CIBIL' - ICICI Bank Ltd

- USA PATRIOT ACT CERTIFICATION

- Forms

- Follow this checklist to stay secure

- Coronavirus

- Unsuccess - ICICI Bank

- Adhar Primer

- ICICI Bank Ltd : Aadhar UID Number

- Get your User ID

- Debenture Holders- Terms and Conditions - ICICI Bank Ltd

- Malicious Code Detected

- Generate Password Online for NRI - ICICI Bank Ltd

- ICICI Bank Regulatory Disclosure

- Safe Help

- Privacy

- Corporate Banking

- Important Notice

- videokycstatus

- Success

- ATM campaign exclusively for other bank card holders - ICICI Bank

- Stay Connected

- SMS Your Experience

- Survey Feedback

- know-more-about

- rekyc-demo

- Multilingual Disclaimer

- Festive Bonanza Terms And Conditions

- Code of Commitment - ICICI Bank Ltd

- Pockets by ICICI Bank

- Trouble Logging in

- ICICI Bank Ltd : Do Not Call Registry

- Re-KYC Demo Videos

- Gift voucher on your first Internet Banking loginams with upGrad - ICICI Bank

- Contribution to PM-CARES Fund

- Credit Card Statement, Bank Account Statement, Home Loan Statement - ICICI Bank

- Browser Padlock

- NRI Banking

- Retail Holidays Calendar

- USE OF UNPARLIAMENTARY LANGUAGE BY CUSTOMERS

- CGTMSECalculator

- Interest Rates

- Sitemap

- Login Revamp

- Customer Service Policies - ICICI Bank Ltd

- Home Buyers Smartbook

- campaigns

- InstaBIZ

- Root Device Check

- Compliments

- services

- Developer-Option

- Integrated Ombudsman Scheme

- test

- VPN

- USB-Debugging

- Infosys Smart Card FAQs

- Breadcrumb test

- Emulator Detection

- Developer mode detection

- Repackaging

- Code Injection Protection

- Key logger protection

- Task hijacking protection

- html

- UPI

- homepage

- product and services

- Appchecksum

- Gold Loan

- rbi-mandate

- test

- AAM-557 Offers and Videos

- Terms and Condition

- Revamp 1.4 and 4.1a&b

- Venkat-test

- Venkat-test

- PL Revamp Page Calculator

- AAM-880 NPS Calculator

- AAM-880 NPS Banner

- Venkat-test

- playground testing pages

- revamp 10.2B

- test

- Revamp Demo

- Revamp Pages

- Financial Literacy Week 2024

- video-test

- money2india

- Symbiosis

- Broken Url Utility

- Performance Matrix Utility

- Personal Banking & Netbanking Services Online

- Farm Equipment Loan

- Farm Equipment Loan EMI Calculator - ICICI Bank

- FD Admin Console

- test-page

- Retail

- Wholesale

- Internet Banking Login Process test video

- shivaji test

- LAS Banner

- Banner with EMI calculator

- Public Provident Fund

- PPF Designated Branches

- PPF Service Request

- More

Want us to help you with anything?

Request a Call back

- ₹500

- ₹150000

- 5 Years

- 25 Years

7.10%

*₹18,18,209

₹40,68,209

+80.80%

*Interest rate is subject to change as per Government’s rule

More reasons to choose ICICI Bank’s PPF

Assured returns with low risk

Invest in a safe option and get assured returns

Completely tax free

Amount deposited upto Rs. 1.5 Lacs a year, interest earned yearly & maturity amount is tax free

Save small and build wealth

Build wealth over years by saving as small as ₹500 & maximum of ₹1.5 Lacs in a year

Loan against PPF

In an emergency? Avail loan against PPF between 3rd to 6th year

Assured returns with low risk

Invest in a safe option and get assured returns

Want to transfer your PPF account to ICICI Bank?

PPF account can be transferred from one authorised bank or Post office to ICICI Bank.

At the existing bank/post office

1. Submit PPF transfer request.

2. The bank/Post office will send the following original documents:

-

Certified copy of the account

-

Account opening application

-

Nomination form

-

Specimen signature etc.

-

Cheque/DD of outstanding balance in the PPF account to ICICI Bank

At ICICI Bank

1. Customer will be informed about receipt of transfer of documents

2. Customer is required to submit the following:

-

Fresh PPF account opening form (Form A)

-

Nomination form (Form E / Form F in case of change of nomination)

-

Original PPF passbook

-

Fresh set of KYC documents

Public Provident Fund FAQs

What is a Gold Loan?

A loan against your gold jewellery is known as Gold Loan or a Jewel Loan. At ICICI Bank, a customer can quickly avail a Gold Loan for any value between Rs 10,000 to Rs 1 crore.

Salient features of Gold Loan like ease of documentation and instant disbursal, make it an easy and convenient way of securing funds.

How does one get a Gold Loan?

To get a Gold Loan, you can walk into any ICICI Bank Branch offering a Gold Loan with your jewellery and avail a Gold Loan for any value between Rs 10,000 to Rs 1 crore. With our simple documentation process (only KYC required), you can avail the loan, across the counter, quickly. Alternatively, you can give a missed call on 84448 84448 or <apply online for a Gold Loan>. Our representative will call you and guide you with all the necessary details. You can also check your Gold Loan eligibility with our Gold Loan Calculator.

What is the interest rate of a Gold Loan?

ICICI Bank Gold Loans come to you at attractive interest rates, with a minimum interest rate of 11% per annum, based on the prevalent market situation. The Gold Loan interest rates will, however, vary according to the product variants.

How long does it take to complete a Gold Loan approval process?

ICICI Bank Gold Loan provides a quick loan disbursal in just 60 minutes. This is however, subject to the verification of the gold and other documents that you submit. Approvals are at the sole discretion of ICICI Bank.

What are the documents required for the approval of a Gold Loan?

A Gold Loan requires a very simple documentation process and doesn’t require you to share income proofs. The documents required for a Gold Loan are:

- Two passport size photographs

- ID proof such as, Driving Licence, Form 60/61, Passport Copy, Voter ID Card, Aadhaar Card or Ration Card. Any one of the documents needs to be submitted. PAN Card issued in India is no longer considered as a valid identity proof

- Address proof such as Driving Licence/Voter ID Card/Ration Card/Aadhaar Card/Passport Copy/Registered lease agreement, with not older than 3 months utility bills in the name of your landlord (any one)

- Proof of land holding needs to be provided, in case of an Agriculture Loan of more than Rs 1 lakh.

What is the maximum limit on the Gold Loan that can be availed?

A Gold Loan can be availed for a minimum of Rs 10,000 and maximum of Rs 1 crore, per customer.

Public Provident Fund Blogs

Public Provident Fund Reviews

I can view live share prices, trade shares, invest Mutual Funds and insurance with my seamless and secure 3-in-1 Online Trading Account.

I can view live share prices, trade shares, invest Mutual Funds and insurance with my seamless and secure 3-in-1 Online Trading Account.

I can view live share prices, trade shares, invest Mutual Funds and insurance with my seamless and secure 3-in-1 Online Trading Account.

I can view live share prices, trade shares, invest Mutual Funds and insurance with my seamless and secure 3-in-1 Online Trading Account.

I can view live share prices, trade shares, invest Mutual Funds and insurance with my seamless and secure 3-in-1 Online Trading Account.

I can view live share prices, trade shares, invest Mutual Funds and insurance with my seamless and secure 3-in-1 Online Trading Account.

I can view live share prices, trade shares, invest Mutual Funds and insurance with my seamless and secure 3-in-1 Online Trading Account.

I can view live share prices, trade shares, invest Mutual Funds and insurance with my seamless and secure 3-in-1 Online Trading Account.

I can view live share prices, trade shares, invest Mutual Funds and insurance with my seamless and secure 3-in-1 Online Trading Account.

I am a good tester with good analytical skill

Download

iMobile App

Click to Enlarge

Download

Pocket

Click to Enlarge